- A new order would authorize the US to sell assets belonging to Russian-sanctioned individuals.

- The aim is for the proceeds to be used to help fund Ukraine's defense.

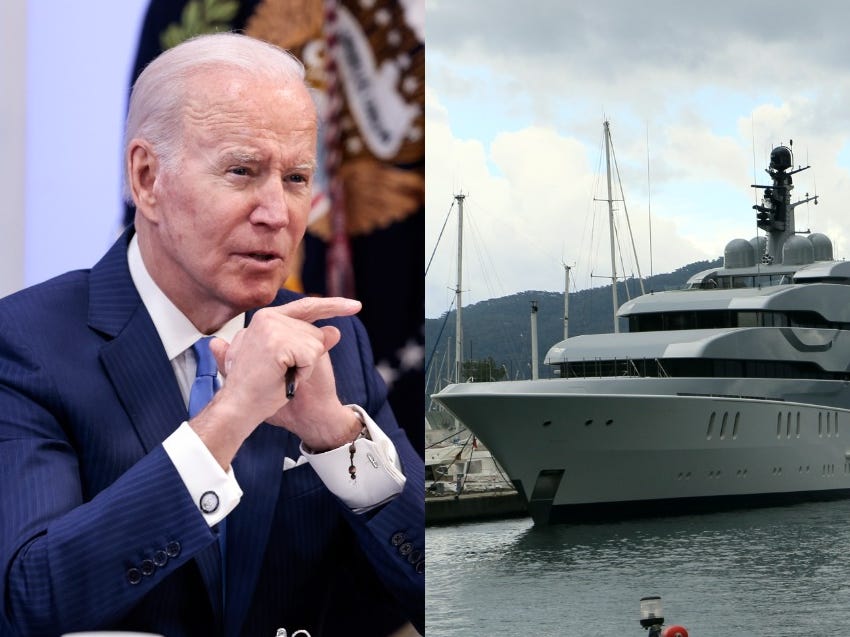

- The US, however, only seized a $90 million, 255-foot yacht belonging to Viktor Vekselberg.

A new executive order from President Joe Biden would grant the US wider authority to speed up the sale of assets seized from sanctioned Russian oligarchs and use the proceeds to support Ukraine as it fends off the Russian invasion.

Assets currently under US control include cash in US bank accounts, as well as a $90 million, 255-foot yacht belonging to Viktor Vekselberg, which was captured earlier this month in Spain.

A 325-foot superyacht belonging to Suleiman Kerimov has also been seized in Fiji after the US requested Fijian authorities to carry out the seizure. The FBI later found evidence incriminating Kerimov of US crimes, according to the Department of Justice.

Meanwhile, a European Union taskforce has been particularly busy, snagging more than $30 billion in boats, helicopters, real estate, and artwork, a European Commission official told Insider.

The US and the EU are joined by the UK, Australia, Canada, and Japan as members of the Russian Elites, Proxies, and Oligarchs (REPO) Task Force, which formed last month to track and coordinate the capture of sanctioned oligarchs' assets.

Although the order on April 28, from the White House says it aims to "improve our ability to enforce foreign restraint and forfeiture orders in the United States," experts told Insider the process is still unclear.

Transferring yachts to the US or the UK would incur considerable expense, said Benjamin Maltby, a partner at Keystone Law in the UK and an expert in yacht and luxury asset law. While selling them in place under US authority "will only add another layer of unnecessary administrative expense and delay."

Shane Riedel, financial crimes expert and the CEO of Elucidate, whose work focuses on monitoring financial transactions, pointed to the period following the 1979 Iranian revolution, when a lack of a legal framework to redirect funds frozen by Western governments meant they remained untouched in locked accounts for decades.

"When the sanctions against Iran were lightened," referring to the lifting of the United Nations sanctions on Iran in 2016, "there was a big export of cash," Riedel said, explaining that Republicans protested that the US was giving money to Iran, when in fact it was Iranians' own frozen funds that had been held for 35 years.

"You can't liquidate those assets, and use them for something else. There's neither precedent nor a clear framework for how that could happen," Riedel added.

The Justice Department announced on April 4, that the seizure of Vekselberg's yacht as "subject to forfeiture based on violation of US bank fraud, money laundering, and sanction statutes." Britt Mosman, a partner at Willkie Farr & Gallagher LLP, said: "From there, the US government has broad discretion in disbursing seized and forfeited assets – including by selling the assets and distributing the proceeds."

She said it would be difficult, however, for individual civil or criminal forfeiture actions to reach the scale needed to impact the rebuilding of Ukraine.

Since assets like yachts and real estate are hard to sell and costly to maintain, the time they spend in legal limbo can add up to significant costs to the governments – and their taxpayers – who seize them. "You could have a really perverse scenario, where governments like the US, UK, Fiji, or others, are forced to actually subsidize those assets until such time as they're then forced to give them back – which is crazy," Riedel said.

"Members of the REPO Task Force would be more incentivized to cooperate with the US in forfeiture actions if there is a clear pathway for the seized property to be liquidated and then used to remediate harms of Russian aggression toward Ukraine," Mosman added.

While assets belonging to oligarchs may be seized, some of their wealth wouldn't necessarily be tied to Russia as Shiedel added that in some cases, they have made their fortune outside of Russia. This includes Oleg Deripaska, for whom parts of his wealth were generated in Switzerland on the back of activities there.